Douglas County Enterprise Zone

Douglas County Enterprise Zone

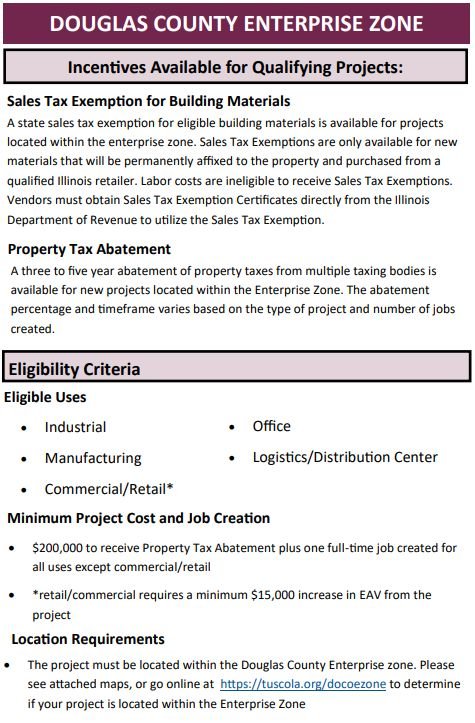

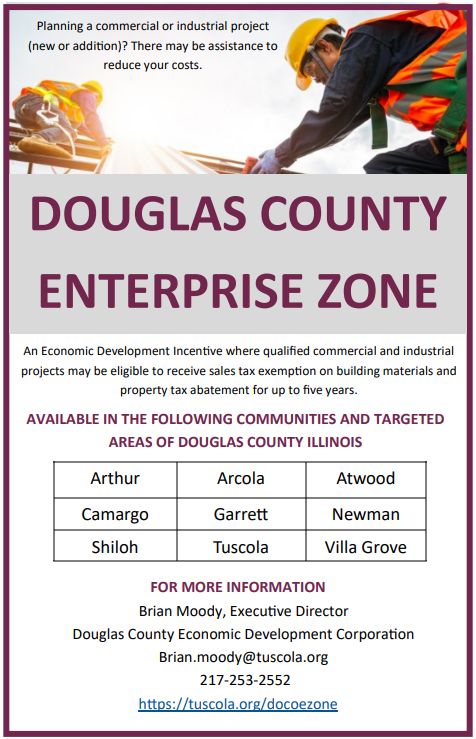

Douglas County Illinois has a large enterprise zone that encompasses targeted properties throughout multiple rural communities. The Enterprise Zone is an incentive to help businesses who are building new or making permanent improvements to their property. The main benefits of an eligible enterprise zone project include sales tax exemption on building materials and property tax abatement on improvements.

Sales Tax exemption on building materials

Contractors and subcontractors working on eligible projects within the Enterprise Zone may apply to receive sales tax exemption on all building materials which will be permanently affixed to the building. This includes everything from paint, wallpaper, carpeting, HVAC systems, lumber, roofing materials and more. This savings varies depending on where the materials are purchased but ranges from 6-7% savings.

Property Tax abatement

Eligible projects within the Enterprise Zone may apply for property tax abatement for three to five years depending on the type of project. Taxing bodies throughout Douglas County have agreed to abate the taxes for a limited time on new developments to encourage new construction in the county. Once the abatement period ends, all projects will be on the tax rolls adding to the economic prosperity of the county for years to come.

Please review the following for more information

Applications

- EZ Project Application

- Addendum A

- MOU-Addendum B (when complete)

Map of the Douglas County Enterprise Zone (areas highlighted in orange are included in the zone)